The times they are a-changin'

ROUNDUP

STEVE ANDERSON

MAY YOU LIVE IN INTERESTING TIMES.

That's a traditional Chinese curse that is proving all too appropriate for many motorcycle companies. Right now is a time of changes (some, but not all. painful) in the business and economics of the motorcycle industry. While this subject is not nearly as dynamic as motorcycles themselves, decisions being made today will affect you in the very near future. At stake are the nature of new motorcycles offered, their cost, and the quality of the dealerships selling them. And these changes are coming.

For the Japanese companies, two factors are making these days interesting. The first sprang from their ow n mistakes of the past decade, particularly the market-share wars of the early 1980s. By pumping an over-supply of motorcycles into a declining U.S. market, and relying on promotions and discounting to rid themselves of these bikes, the Japanese did long-term damage to themselves and to motorcycling. Some of the symptoms were rapidly falling prices for used bikes, the heavy discounting of unsold non-current models, and failing dealerships.

But while the policies which created that situation have been under the control of the motorcycle manufacturers, the second factor, the fall of the U.S. dollar against foreign currencies, has not. The truth is that importing anything into the U.S. from Japan or Europe is far more expensive today than it was four years ago.

In reaction, the Japanese motorcycle companies are taking a longer look at the market. They want to make

money again, and continue to do so, rather than maintaining their targeted market share while bleeding red ink. And even though some of the effects of that policy are painful, it should, in the end. be good for the sport.

One of the not-so-pleasant effects will be higher prices. As mentioned here in April, the yen-doliar exchange-rate situation has been rapidly inflating motorcycle prices, and that escalation has gone even farther since; as an example. Honda's latest price for the 600 Hurricane is $4798. Other companies have yet to raise their prices that high, but you can be sure that Honda's example won't go unheeded.

But while prices are up, the supply of motorcycles is down; no company wants to be caught with warehouses bulging as they were just a few' years ago. Consequently, most of the Japanese companies are being so cautious in their imports that the more-popular 1988 models are largely sold-out at this point. And the warehouses have been cleared of their huge inventory of early-1980s noncurrent models.

So, between higher prices and short supply of new bikes, the demand for used motorcycles is at its highest in quite some time; in Southern California, the price of a late-model used sportbike (a Ninja 600, say) may be $500 higher this year than last. And while other secondhand motorcycles may not have appreciated quite that much, their prices have at least stabilized.

This increase in prices has also led to new interest in smaller-displacement categories. The 250 Ninja and the EX500, for example, are currently among Kawasaki’s best-selling models. Much as in the early 1970s, new riders are starting out on bikes with reasonable performance.

With fewer bikes being sold in the U.S., the Japanese companies have been shrinking their American operations. The internal paring at the distributor level has already taken place, so a thinning of the ranks of motorcycle dealers will be next. The larger companies will strive to strengthen their good dealerships, while not replacing the weak ones that fail. Fewer, stronger dealers, they reason, can offer better service and customer support.

Of course, maintaining a strong dealer network has always been one of Harley-Davidson’s policies. And that, along with more-competitive pricing (thanks to the high yen and improved manufacturing techniques at H-D) and better motorcycles, has made this a year of nearrecord Harley sales.

Harley’s recent success will influence future H-D motorcycles. While the company will never give up its traditional V-Twins, it could, in the-not-too-distant future, offer some bikes outside of its current cruiser and touring niches, perhaps even a thoroughly updated XLCR Café Racer. There might even be new engines coming. Right now, Harley has the cash and the confidence to move forward, and we think the company will take some bold steps.

The Japanese are rethinking their motorcycles, as well. A Honda insider recently told us that his company was retreating from “niche marketing,’’ and wanted to make more general-interest, unspecialized models. A first example is the 650 Hawk GT; others will follow soon. One niche that Honda seems to be leaving is the ultraperformance market, reducing the chance that we might see machines like the RC30 in the United States—unless they’re in handful numbers for racing homologation.

Expect all the Japanese companies to stop changing their models simply for the sake of change; the economics of today's market won’t allow two-year models. Also, expect the Japanese companies to be more marketdriven; right now, they’re more receptive than ever to hearing about what you want in a motorcycle.

At the same time, these same companies are less able to justify models aimed solely at America, or any other single market. We recently talked with an American product-planner for one of the Japanese companies; he was just back from two weeks in Europe where he had been hammering out plans for 1990 and later models with his European counterparts. He told us that these bikes will be compromises between what plays in Peoria and what’s mainstream in Munich.

So, in the end, the conclusions about the motorcycles of the near future are fairly clear. They will cost more, and a larger share will certainly be made in America (at Harley’s plant, as well as at Honda’s and Kawasaki’s).

On the average they will be a little smaller in displacement and have a longer model life, and they should hold their value longer. These future bikes may retreat slightly from the current trend toward specialization. Fewer dealers will sell them, but the ones that do will probably pay better attention to their customers. The most important thing, though, will remain the same: Motorcycles will continue to be fun, fast and exciting.

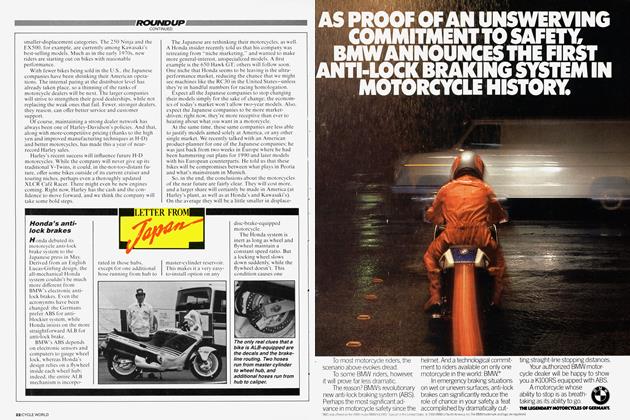

Anti-lock BMW

Harley-Davidson Springer

Harley continues to capitalize on retro-bike popularity with a new version of its classic-looking Softail: the Springer. What's new about this model is something old: a “springer” front fork, much like that used on Harleys 40 years ago, and popular on choppers since.

Essentially a leading-link front fork, the springer design gets its name from the coil-spring stacks located up ahead of the triple clamps. Harley claims that new bearing designs at the link pivots have cured the wear problems that persisted in classic days, and that the Springer actually offers a more compliant, lower-friction ride over small bumps than models with a telescopic fork.

At $ 10,695, the Softail Springer carries a $700 premium over a telescopically forked Softail Classic. Also available is a $ 1785 conversion kit that allows any Softail owner to bolt the springer front end to his bike.

Rumors of Euro-bikes

Boy, do we hear rumors. Not only do people whisper secrets to us about the next motorcycles from Japan, but they also tell stories about what may come from Europe. Here are the ones we think are the most likely to materialize soon.

BMW will introduce a 16-valve K100 this fall. It will use the Paralever suspension and BMW’s anti-lock brakes, and its styling will be all-new, with hints of Bimotas and Ducati’s Paso. What the new bike will not do is be a direct replacement for anything in the BMW range; it instead will be a high-price addition to the top of the line. It’s not certain yet whether all K100 models will receive the new suspension, but what is known is that the K75 will not get its own 4-valve-per-cylinder head in the near future.

Neither will a new Boxer engine be forthcoming soon. German magazines are full of stories of 4-valve-percylinder flat-Twins, and BMW management drops coy hints that they’re studying such a powerplant. But don’t hold your breath; BMW’s current R100 engine will soldier on for at least another year or two-

Cagiva/Ducati/Husqvarna will bring back the successful Ducati Paso with minor improvements, and will offer a heavily updated FIS. Spotted testing in Italy was an FI frame carrying a Paso engine with the reversed rear cylinder head and downdraft Weber carburetor. It had Paso wheels and tires, but the bodywork was all-new.

The fairing shape and rectangular headlight were directly from the 851 8-valve Superbike. With the Paso engine and mufflers, Cagiva should have an easy time certifying the new FIS for legality in all 50 states.

Also expected for 1989 is the enduro version of the Cagiva WMX250 motocrosser. Equipped with a lighting coil, a six-speed gearbox and minor chassis updates, this new enduro bike will wear a Husqvarna nameplate. Also expected is the Dart 350, a fully faired, sporty V-Twin streetbike.

Moto Guzzi is very excited by the success of Doug Brauneck on Dr. John Wittner’s Moto Guzzi. The Italian factory has just finished building three replicas of the bike for European racing, and we hear that these may be followed by a limited run of 8-valve, floating-gearcase Moto Guzzi racebikes for select customers—though perhaps not as many as the 200 85 1 8-valve Superbikes that Ducati recently released. The good Doctor’s lips are sealed on this matter, but if the Guzzi people don’t capitalize on his success, they’re wasting a valuable opportunity. In any case, the lessons being learned now will likely show up on the 1991 Fe Mans.

But for next year, the most likely update to the current 1000 Fe Mans will be fuel injection. It’s a technology Moto Guzzi is experimenting with in the home market on a touring model; injection would help achieve emissions control in the U.S., along with good power.

View Full Issue

View Full Issue