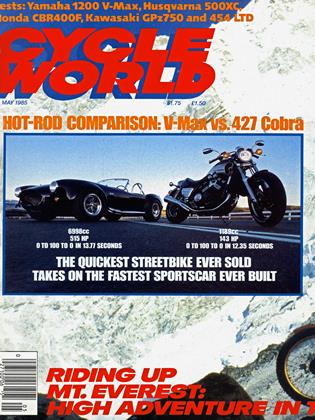

Motorcycle Leasing: The Next Alternative

ROUNDUP

DAVID EDWARDS

You can probably have your pick of reasons for motorcycling’s recent sales slump. But one explanation that keeps cropping up is the difficulty new buyers experience when trying to finance that two-wheeled slice of the American dream.

Well, there are a couple of companies out there trying to alleviate the problem through a technique that has been used in the automobile world for years but that only recently has been applied to motorcycles: leasing. And if you’re in the market for a new bike, it’s worth a closer look.

In some areas of the country—carcrazed southern California, in particular-leasing has become so popular that as many as half of all the new cars that leave dealerships are leased. Experts predict that by 1990 that figure will jump to 75 percent.

The biggest reason for leasing’s popularity is simple: There's no down payment involved. As difficult as it can be to come up with a 10or 20-percent down payment in today’s economically tough times, it’s easy to see why automobile leasing is reaching epidemic proportions.

One company that’s applying its auto-leasing expertise to motorcycles is Gaines Service Leasing Corporation. Under a program Gaines calls Easy-Lease, participating dealers are equipped with a computer system tied into Gaines headquarters in New Jersey. If a potential customer is interested in leasing a motorcycle, the salesman inputs the buyer’s credit information into the computer and, says Gaines, has a decision on the application within 30 minutes.

Gaines claims that it has very liberal credit criteria; its prerequisites are a good employment record, two credit references, no consistent pattern of payment delinquency, and no more than two residences in the last five years.

Once credit is established, the customer is able to take advantage of leasing’s benefits. Chief among these, of course, is the absence of a down payment. Another attractive feature Gaines offers is that accessories, insurance and mechanical-breakdown coverage can be included in the lease plan if the customer so wishes. The lease payments can be spread out over 48 months, and at the end of the lease period, the customer can simply return the motorcycle, or exercise a buy-back option and keep the bike.

Gaines claims that dealer interest has been “overwhelming,” and that more than 500 shops have signed up since the program's inception in January. But it's no wonder that the leasing concept is being so well-received; Gaines estimates that the program can help dealers move 25 percent more units, mostly by simplifying matters for the impulse buyers who are easily put off by the hassle of getting a motorcycle loan. And EasyLease can be used to obtain not just streetbikes, but dirt bikes. ATVs, scooters and mopeds as well.

BMW dealers won’t need Gaines’ services, however, because BMW has had its own leasing plan since early 1984. And although the program is too new to offer any real conclusions, one BMW official predicts that leasing will quickly become “the way to go” for moving new bikes off the sales floor.

You can bet that other manufacturers will be keeping track of Gaines’ and BMW's successes in the leasing field. It just may turn out that leasing will be the motorcycle financing method of the future, and that down payments will become a thing of the past.