Not All Motorcycle Insurance Companies Are Alike. Some Take Your Money And Go Out of Business.

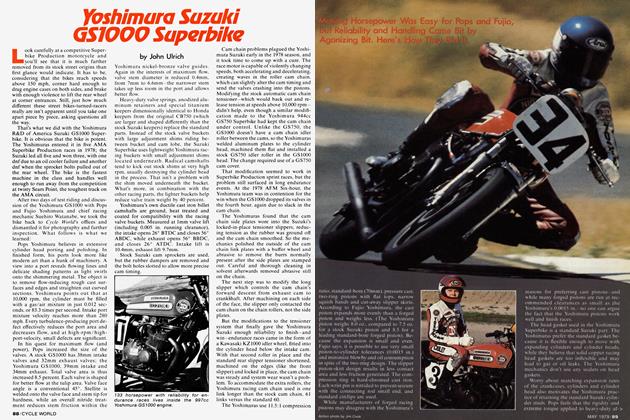

August 1 1981 John UlrichNot All Motorcycle Insurance Companies Are Alike. Some Take Your Money And Go Out of Business. John Ulrich August 1 1981

Not All Motorcycle Insurance Companies Are Alike. Some Take Your Money and Go Out Of Business.

John Ulrich

This is a true horror story about buying motorcycle insurance. A rider who'd just bought a new Honda 750 went shopping for the best price on an insurance policy. He considered a policy underwritten by Eldorado Insurance Co., then settled on Mobile Insurance Co., which had the same coverage for less money.

He'd just paid a $250 premium when a notice came from the state insurance commission. Mobile Insurance Co. had been ordered into receivership. Out of business. Gone.

With his $250.

He filed a claim with the insurance commission for a premium refund, but never got a dime. The motorcycle dealer who sold the policy said he was extremely sorry, but couldn't do a thing. The dealer told the rider that he would have to buy another policy, with a different company. How about Eldorado Insurance Co.?

The year was 1975. The rider was in college on a shoestring budget, working evenings in a drugstore to make ends meet. He scraped up the money for another policy, but instead of returning to his dealer or shopping for the best price, he called a company specializing in insuring races, and talked to an agent whose name he took from a motorcycle magazine article about organizing high school motocross events.

“I need a company that is bedrock solid,” the rider told the agent, “one that will be around after I pay my money.” “No problem,” the agent said. He sold the rider a policy from American Reserve Insurance Co., which he said was a huge concern active in motorcycle insurance for a long time.

A court order placed American Reserve Insurance Co. under a conservatorship on May 30, 1979. The company was ordered liquidated on August 2, 1979.

Fortunately, the rider's policy with American Reserve had expired before the company's collapse, and he hadn't renewed.

He might not have been so lucky if he had chosen Eldorado instead of American Reserve. Eldorado was liquidated on December 11, 1978.

It sounds incredible. Most people take it for granted that all insurance companies are alike, being regulated by state govern-

ments. A few, considering themselves, knowledgeable consumers, shop around for the best coverage at the best price. Nobody thinks for a moment that the company they buy insurance from may go out of business, taking their money with it.

But it happens. Insurance companies are businesses, no more and no less, and sometimes they do go out of business.

There are more than 1700 companies selling property and casualty insurance in the United States. Between January 1, 1975 and April, 1980, about 90 companies were ordered by courts or insurance corn-i missions to suspend operations; were dissolved, placed in liquidation, placed in conservatorship, or placed in receivership; voluntarily dissolved or liquidated; or had their licenses to operate suspended, cancelled or simply not renewed. In other words, about 90 companies went out ol* business, taking policyholders' money with them, and that figure doesn't includecompanies on the brink of failure that merged with others or re-insured their policies before folding up.

So, insurance companies fail. That doesn't mean you have to be the one left* holding the policy. There are ways to investigate the insurers before handing over the money.

First step, or something to do while you're shopping for the right coverage, is to learn the name of the company which will underwrite your policy.

Sometimes agents don't volunteer this. Sometimes they'll refuse or stall, whicl\ should be your clue that somebody may know something they don't want you toj know, and your time to move on down the list of prospects.

Next, call the state insurance commission and make sure that the company is licensed to do business in the state. (As a rule, insurance commissions will tell the* public only whether or not a company is, licensed, and will offer no other guidance as to picking an underwriter.) The correct name, address and phone number of a state's insurance commission can be obtained from city halls, local insurance agents, libraries, telephone directories and state representatives.

If the company is licensed, it's time to check the company's financial condition. The Alfred M. Best Co., (Oldwick, New Jersey 08858), is an independent rating firm which uses sophisticated formulas to evaluate an insurance company's financial well-being, then publishes its ratings in a book titled Best's Key Rating Guide,' Property-Casualty. (Best also publishes ratings of life insurance companies in a separate guide.)

The Best Cö. ratings consider five measures of financial stability, including con> petent underwriting, cost control, adequate reserves, net resources to absorb' unusual shocks (or losses) and soundness of investments. Companies are assigned one of six “general policyholder's” ratings, from A + and A (excellent) through B + (very good) and B (good) down to C + (fairly good) and C (fair).

New insurance companies must have five years of operations before being rated, and some companies, disagreeing with the rating methods, decline to be rated or refuse to supply the Best Co. with information needed to make the ratings. But as a whole, insurance companies support and recommend the Best Co. ratings as a good indicator of financial stability.

The Best guide is updated each year and can be found in the reference section of libraries. Some banks have current copies of the guide, as do most independent insurance agents.

While this detective work is going on, the prudent buyer is also getting quotes and asking about the various ways you can buy motorcycle insurance.

This, like nearly everything connected to the subject, is involved. Probably the first way that pops into most minds is to deal with the giants, like Allstate. Offices in every small town, obviously financially stable and well run. Then there are general insurance agents, the guys who work for you and shop around in your behalf, getting the right policy at the best price from one of the various companies they represent.

As bikes have become more popular, not to say socially acceptable, they've become good business. Also, some of the giants, Allstate for one, don't really like motorcycles much and never mind getting even with OPEC. Allstate won't insure your bike unless you've also got your car covered there and it's going to be tough working out any special factor you may have. i

The motorcycle companies worry about this. Most of us finance when we buy, and ' because this means insurance as well, rider who can't buy insurance aren't as likely to buy motorcycles. The manufacturers and distributors have worked with some big underwriters who do like motorcycles and come up with programs with which the dealer himself can sell you the insurance, right along with floorboards and pipes and saddlebags.

There's also mail order, or mail advertising by underwriters who have agents across the country and would like it if riders went to them instead of the household names.

The last two—not to endorse any type, just advise—are the best bets for special coverage. Specialists in motorcycle insurance speak the language. Some offer seasonal coverage, so you aren't paying for protection when the snow is on the ground and the bike is in the garage under a tarp. Or they may have discounts for riders who've taken rider training. (Just ask the average insurance salesman if he endorses MSF. He won't even know what it is.) If you're one of the lucky chaps with more motorcycles than you can ride at one time,

the underwriter with motorcycle experience is the best bet for a reduced rate, or one-at-a-time coverage.

Look for underwritérs who have been insuring motorcycles for at least three or four years. These underwriters like motorcycles. They understand them and us and they've been working with bikes long enough to know what's going on.

The same thing can apply to an independent agent. Has the agent been in business long? Does the agent know anything about motorcycles? The agent is the policy-buyer's connection to the underwriting company, and can make all the difference in the world. Even in the case of a directwriting company, such as Allstate, the agent can make a huge difference. Someone in the market for insurance should ask questions before laying down his money for a policy, and those questions should include how a claim is handled. If, for example, a policyholder's new bike is stolen, who will handle the claim? Will the agent who sells the policy take care of it, or will it be handled by an adjustor located in a city 250 mi. away? Does the selling agent have claim payment authority? How long should a policyholder expect to wait for payment on a claim? If the bike is stolen or totaled in a crash, what is the maximum amount of money the company will pay to replace it?

Different companies use different information to set rates. Some companies use only the machine's engine displacement when setting liability rates, and only the machine's value when setting comprehensive rates. Other companies take into consideration the age of the rider, the experience of the rider, whether or not the rider has completed an approved rider education course, marital status of the rider, whether or not the bike is fitted with engine guards, the theft rate in the rider's community, whether or not the bike is garaged at night, etc. Generally, com-

panies use statistics to determine patterns in claims, and set rates according to those statistical data. Some companies add a surcharge on comprehensive insurance for certain loss-prone models, often including bikes that seem to be crashed often (Yamaha RD400s), have a lot of power (GS1000 and GS1100 Suzukis, Kawasaki KZ 1000s), or cost a lot to fix (Yamaha Midnight Maxims, BMWs, Ducatis).

Because companies use different information to determine rates, a policy covering the same motorcycle may cost more or less from different companies. A 19-yearold rider might actually be better off insuring with a company that sets rates by engine size and machine cost alone, without regard to rider age. But a 43-year-old rider would probably be able to save money on the same coverage for the same bike by signing up with a company that considers rider age.

Most companies charge more for riders with more than a few traffic tickets or who have been involved in crashes. Some companies will not insure riders with tickets at all. But no matter whether the rider is a “good risk” (no tickets, no crashes, no claims) or a “bad risk” (tickets, crashes, claims), he should compare quotes from at least three companies before putting his money down for insurance.

Ideally, a rider would gather information and quotes from different licensed, financially-sound (rated excellent), motorcycle-experienced companies and make his decision based on coverage, applicable discounts (for completing a rider course, experience, etc.) availability and quality of claim service, agent attitude and anything else that comes to mind.

It takes time, this shopping for insurance. It takes care and thought. But seeing as full-coverage insurance on a new Suzuki GS1100 ridden by a 19-year-old can cost $900 a year or more, the time and effort taken to shop around is worthwhile.

GUIDE TO TOP-RATED INSURANCE COMPANIES

The following is a partial list of insurance companies underwriting motorcycle policies and rated as excellent by Best's Key Rating Guide, a guide to financial stability.

AID Insurance Services Ambassador Insurance Co. of Illinois Austin Mutual Insurance Co.

Avco Financial Insurance Group Balboa Insurance Co.

Celina Insurance Group Compco Insurance Co.

The Continental Insurance Cos. Criterion Insurance Co.

Dairyland Insurance Co.

Emmco/Excel Insurance Cos. Fireman's Fund Insurance Co.

First American Insurance Co.

Globe American Casualty Co. Grange Mutual Casualty Co. Grinnell Mutual Reinsurance Co. Harleysville Mutual Insurance Co. Home Insurance Cos.

Integon Group

Leader National Insurance Co. Lexington Insurance Co.

National Indemnity Co.

Newport Insurance Co.

Northland Insurance Co.

The North-West Insurance Co. Progressive Cos.

Puerto Rican-American Insurance Co. Ranger Insurance Co.

St. Paul Fire & Marine Insurance Co. Scottish & York Int'l Insurance Group S&H Insurance Co.

Southeastern Fidelity Insurance Co. Tri-State Insurance Co. of Minnesota Universal Underwriters Insurance Co. United Fire & Casualty Co.

United National Insurance Co. Workmen's Auto Insurance Co.

View Full Issue

View Full Issue

More From This Issue

-

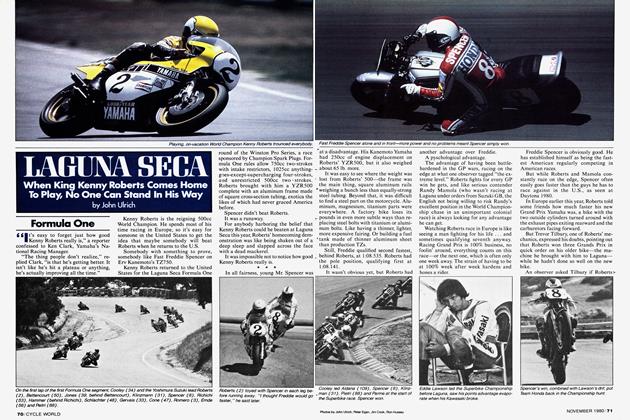

Up Front

Up FrontA Satisfied Mind

August 1981 By Allan Girdler -

Letters

LettersLetters

August 1981 -

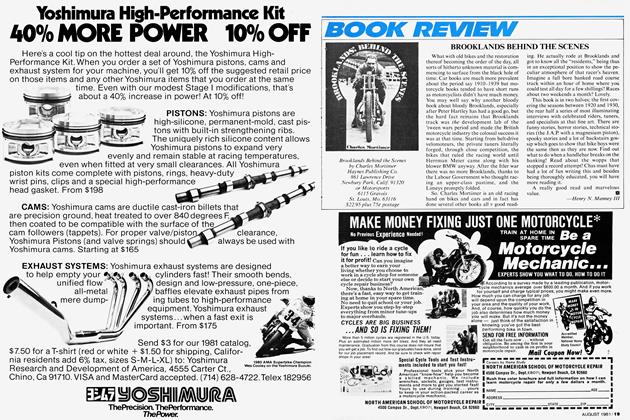

Book Review

Book ReviewBrooklands Behind the Scenes

August 1981 By Henry N. Manney III -

Departments

DepartmentsRoundup

August 1981 -

Motorcycle Insurance

Motorcycle InsuranceWhat It All Means, And How To Know What You Need.

August 1981 By David D. Mallet -

Competition

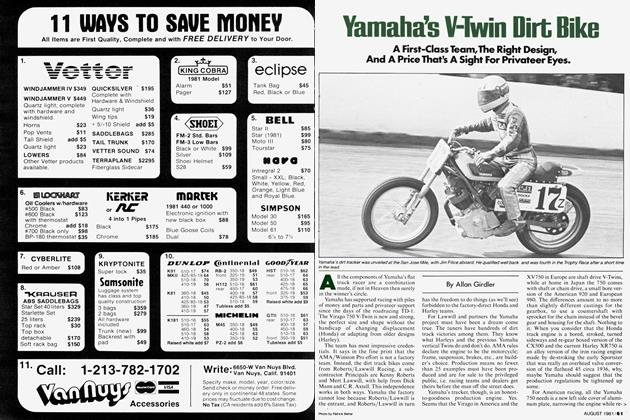

CompetitionYamaha's V-Twin Dirt Bike

August 1981 By Allan Girdler