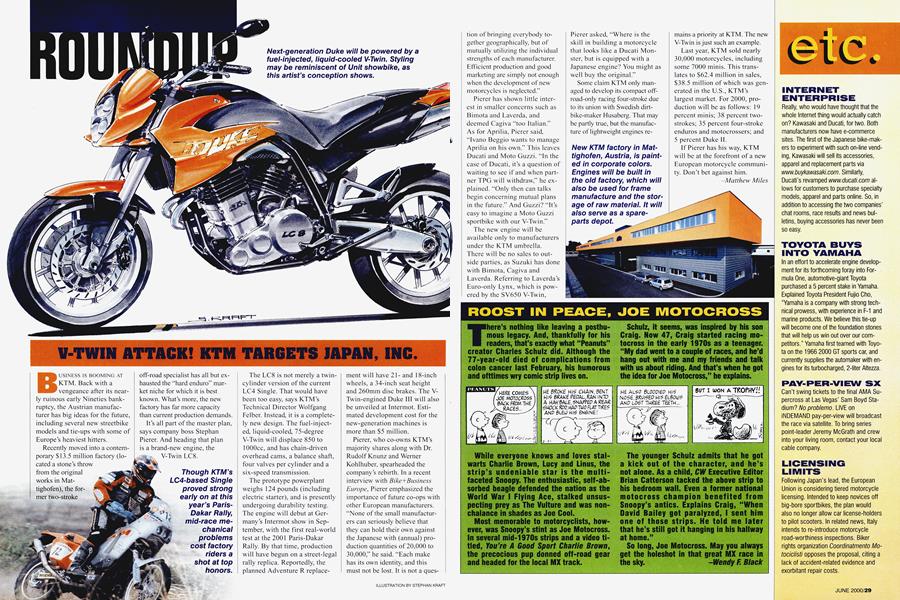

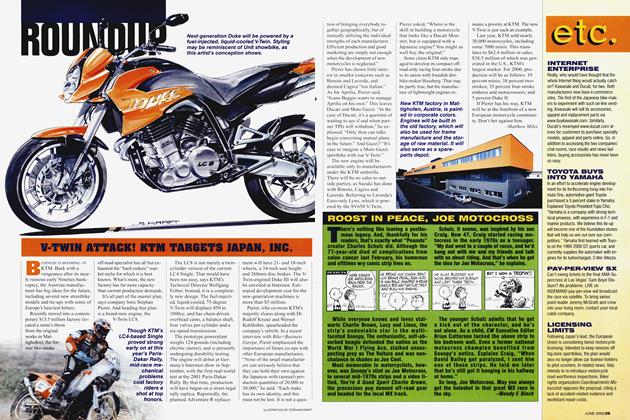

V-TWIN ATTACK! KTM TARGETS JAPAN INC.

ROUNDUP

BUSINESS IS BOOMING AT KTM. Back with a vengeance after its nearly ruinous early Nineties bankruptcy, the Austrian manufacturer has big ideas for the future, including several new streetbike models and tie-ups with some of Europe's heaviest hitters.

Recently moved into a contem porary $13.5 million factory (to cated a stone's throw from the original works in Mat tighofen), the for mer two-stroke off-road specialist has all but ex hausted the "hard enduro" mar ket niche for which it is best known. What's more, the new factory has far more capacity than current production demands.

It's all part of the master plan, says company boss Stephan Pierer. And heading that plan is a brand-new engine, the V-Twin LC8.

The LC8 is not merely a twincylinder version of the current LC4 Single. That would have been too easy, says KTM's Technical Director Wolfgang Felber. Instead, it is a complete ly new design. The fuel-inject ed, liquid-cooled, 75-degree V-Twin will displace 850 to 1000cc, and has chain-driven overhead cams, a balance shaft, four valves per cylinder and a six-speed transmission.

The prototype powerplant weighs 124 pounds (including electric starter), and is presently undergoing durability testing. The engine will debut at Ger many's Intermot show in Sep tember, with the first real-world test at the 2001 Paris-Dakar Rally. By that time, production will have begun on a street-legal rally replica. Reportedly, the planned Adventure R replace-

ment will have 21and 18-inch wheels, a 34-inch seat height and 260mm disc brakes. The V Twin-engined Duke III will also be unveiled at Intermot. Esti mated development cost for the new-generation machines is more than $5 million.

Pierer, who co-owns KIM's majority shares along with Dr. Rudolf Knunz and Werner Kohlhuber, spearheaded the company's rebirth. In a recent interview with Bike+Business Europe, Pierer emphasized the importance of future co-ops with other European manufacturers. "None of the small manufactur ers can seriously believe that they can hold their own against the Japanese with (annual) pro duction quantities of 20,000 to 30,000," he said. "Each make has its own identity, and this must not be lost. It is not a ques tion of bringing everybody together geographically, but of mutually utilizing the individual strengths of each manufacturer. Efficient production and good marketing are simply not enough when the development of new motorcycles is neglected.”

Pierer has shown little interest in smaller concerns such as Bimota and Laverda, and deemed Cagiva “too Italian.”

As for Aprilia, Pierer said, “Ivano Beggio wants to manage Aprilia on his own.” This leaves Ducati and Moto Guzzi. “In the case of Ducati, it’s a question of waiting to see if and when partner TPG will withdraw,” he explained. “Only then can talks begin concerning mutual plans in the future.” And Guzzi? “It’s easy to imagine a Moto Guzzi sportbike with our V-Twin.”

The new engine will be available only to manufacturers under the KTM umbrella.

There will be no sales to outside parties, as Suzuki has done with Bimota, Cagiva and Laverda. Referring to Laverda’s Euro-only Lynx, which is powered by the SV650 V-Twin,

Pierer asked, “Where is the skill in building a motorcycle that looks like a Ducati Monster, but is equipped with a Japanese engine? You might as well buy the original.”

Some claim KTM only managed to develop its compact offroad-only racing four-stroke due to its union with Swedish dirt-

bike-maker Husaberg. That may be partly true, but the manufacture of lightweight engines re-

mains a priority at KTM. The new V-Twin is just such an example.

Last year, KTM sold nearly 30,000 motorcycles, including some 7000 minis. This translates to $62.4 million in sales, $38.5 million of which was generated in the U.S., KTM’s largest market. Lor 2000, production will be as follows: 19

percent minis; 38 percent twostrokes; 35 percent four-stroke enduros and motocrossers; and 5 percent Duke II.

If Pierer has his way, KTM will be at the forefront of a new European motorcycle community. Don’t bet against him.

-Matthew Miles