The X Factor

UP FRONT

David Edwards

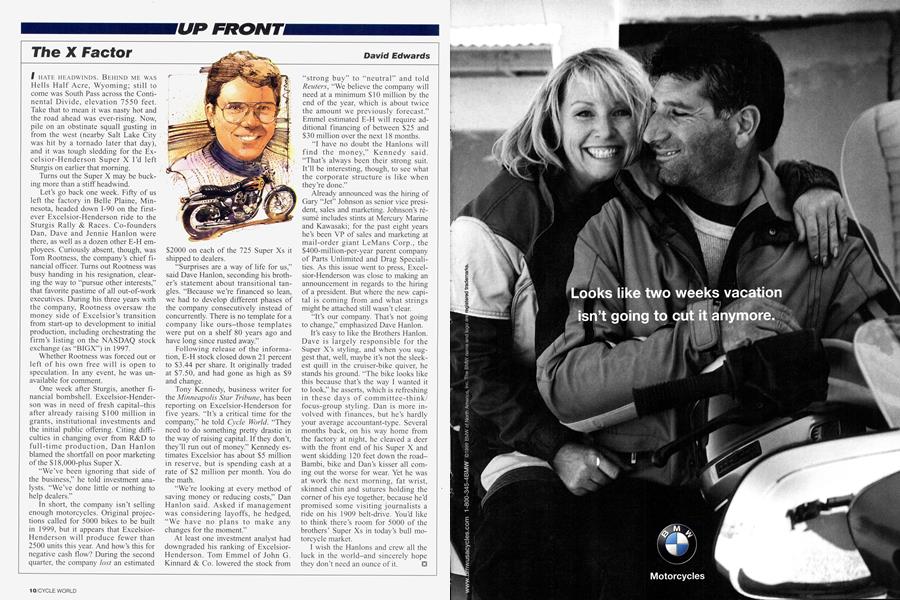

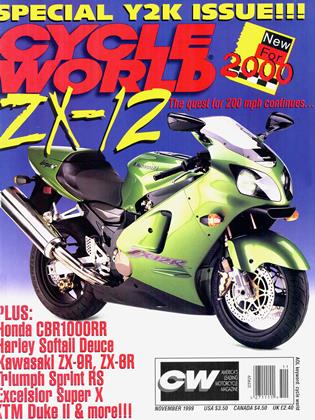

I HATE HEADWINDS. BEHIND ME WAS Hells Half Acre, Wyoming; still to come was South Pass across the Continental Divide, elevation 7550 feet. Take that to mean it was nasty hot and the road ahead was ever-rising. Now, pile on an obstinate squall gusting in from the west (nearby Salt Lake City was hit by a tornado later that day), and it was tough sledding for the Excelsior-Henderson Super X I’d left Sturgis on earlier that morning.

Turns out the Super X may be bucking more than a stiff headwind.

Let’s go back one week. Fifty of us left the factory in Belle Plaine, Minnesota, headed down 1-90 on the firstever Excelsior-Henderson ride to the Sturgis Rally & Races. Co-founders Dan, Dave and Jennie Hanlon were there, as well as a dozen other E-H employees. Curiously absent, though, was Tom Rootness, the company’s chief financial officer. Turns out Rootness was busy handing in his resignation, clearing the way to “pursue other interests,” that favorite pastime of all out-of-work executives. During his three years with the company, Rootness oversaw the money side of Excelsior’s transition from start-up to development to initial production, including orchestrating the firm’s listing on the NASDAQ stock exchange (as “BIGX”) in 1997.

Whether Rootness was forced out or left of his own free will is open to speculation. In any event, he was unavailable for comment.

One week after Sturgis, another financial bombshell. Excelsior-Henderson was in need of fresh capital-this after already raising $100 million in grants, institutional investments and the initial public offering. Citing difficulties in changing over from R&D to full-time production, Dan Hanlon blamed the shortfall on poor marketing of the $ 18,000-plus Super X.

“We’ve been ignoring that side of the business,” he told investment analysts. “We’ve done little or nothing to help dealers.”

In short, the company isn’t selling enough motorcycles. Original projections called for 5000 bikes to be built in 1999, but it appears that ExcelsiorHenderson will produce fewer than 2500 units this year. And how’s this for negative cash flow? During the second quarter, the company lost an estimated $2000 on each of the 725 Super Xs it shipped to dealers.

“Surprises are a way of life for us,” said Dave Hanlon, seconding his brother’s statement about transitional tangles. “Because we’re financed so lean, we had to develop different phases of the company consecutively instead of concurrently. There is no template for a company like ours-those templates were put on a shelf 80 years ago and have long since rusted away.”

Following release of the information, E-H stock closed down 21 percent to $3.44 per share. It originally traded at $7.50, and had gone as high as $9 and change.

Tony Kennedy, business writer for the Minneapolis Star Tribune, has been reporting on Excelsior-Henderson for five years. “It’s a critical time for the company,” he told Cycle World. “They need to do something pretty drastic in the way of raising capital. If they don’t, they’ll run out of money.” Kennedy estimates Excelsior has about $5 million in reserve, but is spending cash at a rate of $2 million per month. You do the math.

“We’re looking at every method of saving money or reducing costs,” Dan Hanlon said. Asked if management was considering layoffs, he hedged, “We have no plans to make any changes for the moment.”

At least one investment analyst had downgraded his ranking of ExcelsiorHenderson. Tom Emmel of John G. Kinnard & Co. lowered the stock from “strong buy” to “neutral” and told Reuters, “We believe the company will need at a minimum $10 million by the end of the year, which is about twice the amount we previously forecast.” Emmel estimated E-H will require additional financing of between $25 and $30 million over the next 18 months.

“I have no doubt the Hanlons will find the money,” Kennedy said. “That’s always been their strong suit. It’ll be interesting, though, to see what the corporate structure is like when they’re done.”

Already announced was the hiring of Gary “Jet” Johnson as senior vice president, sales and marketing. Johnson’s résumé includes stints at Mercury Marine and Kawasaki; for the past eight years he’s been VP of sales and marketing at mail-order giant LeMans Corp., the $400-million-per-year parent company of Parts Unlimited and Drag Specialities. As this issue went to press, Excelsior-Henderson was close to making an announcement in regards to the hiring of a president. But where the new capital is coming from and what strings might be attached still wasn’t clear.

“It’s our company. That’s not going to change,” emphasized Dave Hanlon.

It’s easy to like the Brothers Hanlon. Dave is largely responsible for the Super X’s styling, and when you suggest that, well, maybe it’s not the sleekest quill in the cruiser-bike quiver, he stands his ground. “The bike looks like this because that’s the way I wanted it to look,” he asserts, which is refreshing in these days of committee-think/ focus-group styling. Dan is more involved with finances, but he’s hardly your average accountant-type. Several months back, on his way home from the factory at night, he cleaved a deer with the front end of his Super X and went skidding 120 feet down the roadBambi, bike and Dan’s kisser all coming out the worse for wear. Yet he was at work the next morning, fat wrist, skinned chin and sutures holding the corner of his eye together, because he’d promised some visiting journalists a ride on his 1909 belt-drive. You’d like to think there’s room for 5000 of the brothers’ Super Xs in today’s bull motorcycle market.

I wish the Hanlons and crew all the luck in the world-and sincerely hope they don’t need an ounce of it. U

View Full Issue

View Full Issue