DOES YOUR CLUB OWE INCOME TAX?

Taxes: Befuddling as Well as Inevitable. Here are Some Straightforward Answers to Help Clear the Haze.

ROBERT O. FEE

Our club is a social group—there's no tax on us!

Surprise, but don’t feel bad— you’re in good company. Most road riding groups and a surprising number of competition riders are startled to find that their little social club has tax responsibilities to both the state and federal governments. Unfortunately, when called to task for failure to comply with these responsiblities, ignorance is not a valid excuse. The statutes are on the books and a club is presumed to be familiar with them.

What statutes affect us as a motorcycle club?

The laws are scattered throughout the Internal Revenue Code, and their application to social clubs depends upon your business form. For tax purposes your select group is either incorporated or it is not incorporated.

INCORPORATED

When a group incorporates as a social club (1) they automatically receive state income tax exemption with their charter. To keep the exemption, the state requires the club officers to file an annual information return. Unless the club has a very large income, the return is a simple one-page questionnaire.

The California corporation tax exemption is worth at least $100. That is the minimum tax even if the corporation loses money or is inactive. It’s the price for limited liability (2), the reason most clubs incorporate.

Very few club officers seem aware that the relatively easy to get state exemption means absolutely nothing to the federal government. The Internal Revenue Service dispenses its own tax exemptions and to qualify is difficult. The Exempt Organizations department of the 1RS has some peculiar ideas concerning what benefits the members enjoy and who comprises the general public.

The Internal Revenue Code, Section 6012, states, “Every corporation, unless expressly exempt, must make a return regardless of the amount of its taxable income and of whether any tax is due thereon.”(3)

Mere inactivity of the corporation is not a valid reason for failure to file the required returns. Only a legal dissolution of the corporation terminates that liability.(4)

The return referred to is the standard corporation income tax form 1120.

Our club is chartered by a national organization. Doesn’t it take care of these matters?

Generally not. If it did, you would have no doubts. Your club would not be incorporated in itself, but would operate under the ownership and direction of the parent organization. You would regularly make financial reports and transmit some if not all of your money to the parent who would include your chapter’s records in a consolidated tax return.

Normally, charters and sanctions for which you pay do not transfer any ownership or tax liabilities from you, the buyer, to them, the seller, of such items.

But we’re a non-profit group—our charter says so and our books show it.

The law says, “Although an organization is organized as one ‘not for profit’ under applicable state laws this does not mean that it is tax exempt. Non-profit status may be a prerequisite for exemption, but by itself does not confer exemption.”(5)

“No corporation may claim exemption from the federal tax unless it is determined to be an exempt corporation after submission of proof of exemption to the District Director for the district in which the corporation is located.”(6)

If you have any doubt about your exempt status with the federal government, you probably aren’t. It’s a long, drawn-out experience, one not easily forgotten, and it usually results in a large packet of papers taking up a lot of room in the club files.

How do we get exempt?

The quick answer to that question is “very carefully.” The 1RS Handbook on Exempt Organizations thoroughly answers the question in about 360 pages of fine print. The two-page application form 1025 that looks so simple is tremendously deceiving. One quick “X” to an inadequately considered question and the whole thing is down the tubes. By the time all of the supporting schedules and required information is attached to that simple two-page form, it can weigh up to a pound or more.

When we’re exempt with both the state and federal people, must we still file corporation returns?

No. Exempt organizations must file annual information returns, generally on form 990. Failure to file the required return may result in termination of the club’s exempt status.(7)

is there any way to avoid all this paperwork, bookkeeping and worry?

Sure! Give up your corporate form and limited liability protection, restrict your activities to strictly out-of-member-pocket expenses and you’re home free. No bookwork, no tax returns, taxes, or exemptions, and probably no activity in your club.

THE UNINCORPORATED CLUB

For social clubs, there is one exception to the general partnership rule: “A joint undertaking to merely share expenses is not a partnership.”(8)

If your club is not incorporated and has any income from a non-member, it is considered a partnership for tax purposes. The term “partnership” includes syndicates, joint ventures, associations, or groups (any group) which do not classify as a trust, corporation, or estate.(9)

Most social club members have a hard time realizing that the term “groups” means their little group. Also, any income means just that! The fact that your club calls an entry or admission to some event or dance a donation or the cost of a raffle ticket a contribution does not change its character. The 1RS says it is income and there is no further argument.

Under the partnership rules, the club treasury pays no tax. The partnership form functions primarily as a conduit for transferring income and loss items directly to the individual club members who report them on their own income tax returns.

The quick ones probably caught that word “loss” the first time. If your club promotes a rally and makes money, the members must report their share (whether distributed or not) of the gain on their personal tax return. By the same law, if the club loses money, each member has a loss item that is deductible against his personal income and lowers his tax.

The partnership report is filed on form 1065 and should be completed as early in the year as possible so the club members have the figures for their personal reports due April 15.

Nothing’s been said yet. Weil just let sleeping dogs lie and not bother with it.

You may continue to get by with this, but you had better tread very softly and make no enemies. It only takes one unhappy soul, not even a club member, to blow the whistle to wake up the dogs. And he can get a reward from the govenment for doing it. As you might suspect, the government has several different penalties (18 sections of the code) that are applicable to the situation. They range from $1 to $25,000 and 5 to 100 percent of any deficiencies. In addition, there is the spectre of fraud that can be raised when returns are willfully neglected. Both criminal and civil actions are possible under the law. For the unsuspecting

club member, an audit of the club books could open his personal tax returns to a thorough audit that might not be desirable. All kinds of problems can result for those who willfully close their eyes to their tax responsibilities.

How do we comply with all this garbage?

The simplest way is to retain a professional to prepare your tax returns. The cost will range upward from $20, depending on the complexity of your club’s business affairs. A professional will also assist your treasurer in initiating a bookkeeping system that is complete and probably easier to keep than what he is now struggling with.

When looking for a preparer, bear in mind that his prestige, franchise, or cost of services is no guide to his competence in the tax field. The fact that a preparer is an attorney or an accountant, certified or otherwise, does not make him a tax specialist any more than the title of “doctor” indicates a skilled brain surgeon. It is up to you to determine if your prospective preparer is truly expert in tax matters and practiced in your field of need. Any conscientious preparer will be happy to provide information about his training and to furnish references.

The alternative is to assign the treasurer to do-it-himself and hope that it lucks out. With all due respect to their sincerity, anything more than simple bookkeeping is beyond most club treasurers. Very few are equipped to cope with operating statements, balance sheets, reconciliations, adjustments, and breakdowns required by the more complex tax forms.

It can be done though. Obtain the forms mentioned that apply to your club’s business form and follow the instructions explicitly. Obtain and read the government booklet on business taxes from the 1RS (60 cents). By spending enough time to understand the booklet and instructions, you should be able to complete the task.

Whether you pop for the professional or opt for the fun of do-it-yourself, do it! To ignore your tax responsibilities is a crime for which there are severe penalties and a reward for those who report you.

(1) State of California: A query to the

Commissioner of Corporations or Secretary of State will reveal any variations that might exist in your state.

(2) The corporation can be sued but not the individual members comprising the corporation or club.

(3) I RS Reg. 1.6012-2(-3)

(4) Commerce Clearing House, “Federal Tax Guide,” Paragraph 6421

(5) 1RS Reg. 1.501(a)-l(a)(2)

(6) CCH, Op. Cit. Para. 4503

(7) Code Sec. 501; Rev. Rul. 59-95

(8) CCH, Op Cit. Para. 5001

(9) I RS Reg. 1.761-1

View Full Issue

View Full Issue

More From This Issue

-

Departments

DepartmentsRound Up

March 1970 By Joe Parkhurst -

Departments

DepartmentsThe Scene

March 1970 By Ivan J. Wagar -

Letters

LettersLetters

March 1970 -

Competition

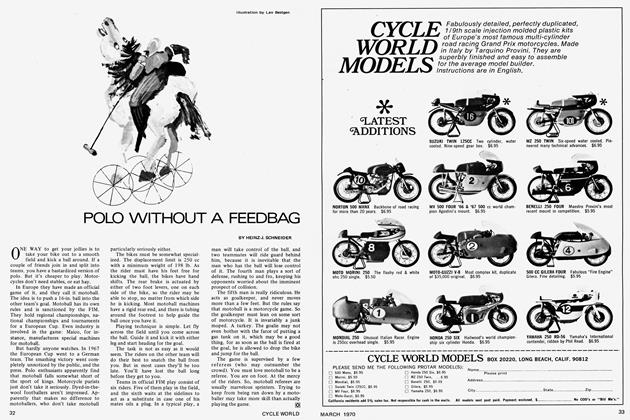

CompetitionPolo Without A Feedbag

March 1970 By Heinz-J. Schneider -

Departments

DepartmentsThe Service Department

March 1970 By John Dunn -

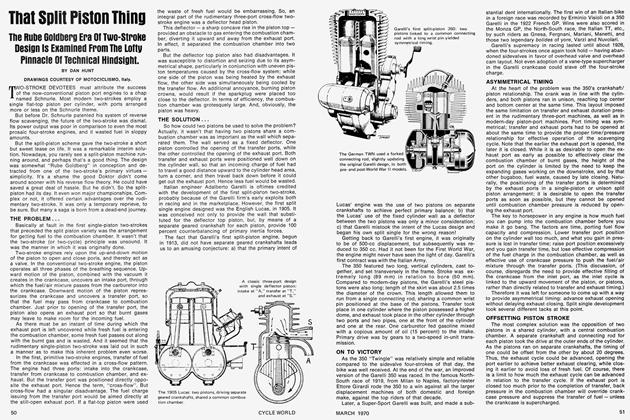

Special Technical Feature

Special Technical FeatureThat Split Piston Thing

March 1970 By Dan Hunt